Elder Fraud is statistically increasing in the senior and near-senior age categories. With more individuals online than ever, scammers are becoming highly adaptable and mimic communications resembling tech staff support, government employees, and romantic partners. Seniors are particularly vulnerable groups as they are typically homeowners with substantial financial savings, good credit scores, and trusting natures.

Fraud Statistics from 2019 to 2021

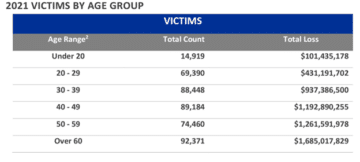

For those in the over 60-year-old category, there was nearly $1.7 billion in losses, a 74 percent increase from 2020, with the average victim losing $18,246 and 3,133 victims losing more than $100,000. Between 2019 to 2020, fraud and identity theft increased by 47 percent, and the recently released FBI 2021 statistics for multiple age categories are alarming.

The increase in fraud and identity theft since 2019 is 47%, according to the Federal Trade Commission (FTC) statistics in the Consumer Sentinel Network Data Book. While younger people were more apt to report losing money to fraud than older people, the median loss of elder individuals was much higher. The top three categories of 2020 scams are identity theft, imposter/fraud scams, and online shopping/negative reviews. They are closely followed by credit bureaus, information furnishers, report users, banks and lenders, and internet services.

Elder Fraud May Be Underreported

Overall, older Americans lost nearly $4 billion to financial scams in 2021, and sadly, seniors are less likely to report losing money to fraudulent schemes. One reason is the older individual may be embarrassed or ashamed of being duped; however, the FBI speculates it could be due to not understanding the reporting process. The FBI Internet Crime Complaint Center is a reporting mechanism for cases of online fraud and other complaints. But the Federal Trade Commission is the main agency collecting scam, fraud, and identity theft reports.

The most common scams, according to the FTC, are:

What We Can Do About It

As percentages for fraud reporting increases with age, it is important to help aging parents and loved ones avoid falling victim. Meeting with an elder law attorney or estate planning lawyer can educate and outline suggestions to handle the monitoring of bank accounts, credit cards, etc., to protect the vulnerable. A financial power of attorney or guardianship may be appropriate to provide a trusted family member or professional financial group the legal access to monitor and manage accounts and quickly identify if there is a problem or suspected financial fraud.

Tech Support Scams

Due to COVID-19, older individuals’ preferences became stay-at-home for health protection, prompting them to go online more frequently, increasing the likelihood of internet scam exposure. The internet of things and all the opportunities it presents, combined with managing apps, software, passwords, updates, and hardware challenges, can create confusion in seniors who are not so savvy about the digital age. Because of these conditions, older adults are six times more likely to report being defrauded through a tech support scam than younger counterparts.

Romance Scams

The highest aggregate financial losses for individuals over 60 years of age occur due to romance scams. Often these older adults experience loneliness, making them easy targets. They may wire transfer money, send gift cards, and make credit card payments to someone they believe is a companion or love interest.

The states most affected by elder fraud (60 or older) rank California first, followed by Florida and Texas, but elder fraud can occur in any state. Educate your loved ones about the most common types of online scams, including:

- Phishing scams involve fraudulent websites or emails that appear legitimate, like banks or other financial institutions. They trick you into disclosing financial data, like bank login credentials or credit card numbers.

- Investment scams convince victims to invest money in fraudulent business ventures or schemes. They promise high rates of return on investment with little or no risk. They even have reviews from fake satisfied customers.

- Fake online stores sell low-quality or nonexistent products. Again, false customer “testimonials” seek to lure customers into purchasing items.

- Charity scams solicit money from unsuspecting donors via a fake charity. Using emotional appeals or false affiliations with legitimate organizations to gain tax write-offs can easily trick a trusting person into giving money.

- Lottery scams use letters or emails to target victims with claims they have won a contest or lottery. Scammers will request personal and bank account information to collect their winnings or prizes.

- Government impersonation scammers call unsuspecting older adults pretending to be from the Social Security Administration, Internal Revenue Service, or Medicare. Some of these fraudulent calls will accuse the victim of unpaid taxes, threatening arrest or deportation if they do not immediately send money. They may threaten to revoke Social Security or Medicare benefits if the victim does not provide personal information like a Social Security number and more. Government agencies will never ask for this personal information on the phone.

- Phone scams and robocalls take advantage of automated phone technology to reach thousands of households from anywhere in the world. One scam will ask, “Can you hear me?” When the older adult says “yes,” the scammer records their voice as a signature to authorize charges on stolen credit cards. Other calls may claim a warranty is expiring on an electronic device or vehicle, and payment is necessary to renew the coverage. Another popular robocall describes an impending lawsuit in a threatening tone with someone claiming to be from a government agency like the police. The scam threatens to arrest or sue if the victim does not pay a fine by a specified deadline.

Many scams are putting older Americans at risk of being defrauded of their money and dignity. The statistics show scam artists are making more money than ever. Establishing a relationship with an older family member or loved one intending to monitor their financial account activity can protect them from losing money. Educating older adults never to give out financial, government ID, or other personal information over the phone or internet is crucial to protect them. The older you become, the greater the risk of elder fraud. Knowing the possible schemes and planning additional oversight of your financial accounts can help protect your or a loved one from elder fraud. Contact our office to talk with an elder law attorney for resources and help to recover from fraudulent activity. Call us at (207)848-5600