The Dilemma of Affording for Long-term Care

Paying for long-term care planning remains a significant challenge for most older Americans and preparing for service payments can be tricky. LTC insurance may cover a portion of services or all of them, and premiums depend on a person’s age, gender, health, location, and other criteria. The American Association of Long-Term Care Insurance lists 2021 average premiums for initial benefits of $165,000 (with a 1 to 5 percent annual growth rate) for a healthy fifty-five-year-old male to be between $1,375 to $3,685 per year. For the same coverage type, a healthy fifty-five-year-old woman can expect to pay between $2,150 to $6,400. Premium hikes tend to be costly because metrics used years ago in the insurance industry were faulty and did not accurately project the real LTSS costs.

What is Hybrid Long-term Care Coverage?

A different payment option is hybrid long-term care coverage. These policies are part annuity or life insurance and part long-term care coverage. You may purchase a policy upfront eliminating any future risk of premium increases, and your heirs may receive a death benefit if you do not need long-term care. This option is an arbitrage approach hoping that you will not require LTSS and that your heirs may benefit. Hybrid policy price comparisons are more difficult to ascertain than a standalone long-term care coverage policy.

How to Utilize a Health Savings Account to Pay for Long-term Care

A third option is for those retirees with sizable health savings accounts to use pre-tax funds to cover long-term care expenses or premiums. Currently, those itemizing deductions can write off long-term care expenses above 7.5 percent of their adjusted gross income on their taxes. Finally, those low-income retirees with assets below a certain threshold may qualify for Medicaid LTSS. Applicants must pass a five-year “look back” period to assure they did not gift or spend down assets to qualify. If you think you may qualify, take this Medicaid eligibility test.

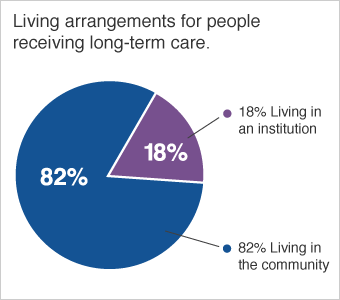

Typically, family members play an important caregiver role in their loved ones who need help regarding activities of daily living. This statement is particularly true in the earlier stages of requiring care, where someone may need help with just one activity of daily living. In-home assistance, community programs, and residential facilities can help your loved one stay as active as possible, accomplishing everyday tasks. The family-style approach constitutes most living arrangements for those who receive long-term care.

Many available resources help older adults continue to reside in-home and participate in their communities. The stay-at-home option in the earlier stages of a significant long-term need, or if projected care requirements may be a matter of two to three months, may be the most viable and cost-effective solution. Pivoting to in-home service provision is the most likely scenario for most American retirees. Nursing home residential space is expensive, and Medicaid can only supply so much aid. While most LTSS stays remain paid care and have relatively short durations, the lifetime risk for expensive out-of-pocket costs runs high.

Unfortunately, receiving paid LTSS care is not equally distributed among the US population. Generally, people with limited education and less financial resources are the most likely to experience severe LTSS needs. Over a lifetime, however, the more well-educated population with different socioeconomic advantages tend to live longer and can outlive their assets. Family is an integral part of the solution for long-term care while the federal government responds to the growing need to make this care more available and affordable. For your best outcome, be proactive in your planning. Most Americans will need LTSS, but few will have taken steps to plan for it.

We’re here to help you start your Long-Term care planning, call us at (207)848-5600 or check out our CONTACT page.