How to protect your inheritable legacy so that its aggregate will exist for future generations requires careful planning. There are always generational differences of opinion as to how best to live and act in the world. Millennials and Generation Xers seem to have distinctly different priorities and politics than their older benefactors in response to climate change, pollution, over-harvesting nature’s capital, and wealth accumulation, to name a few. What is the best way to guide your family heirs over the next generations long after you are gone? Begin with understanding the scope of the most significant transfer of wealth in human history.

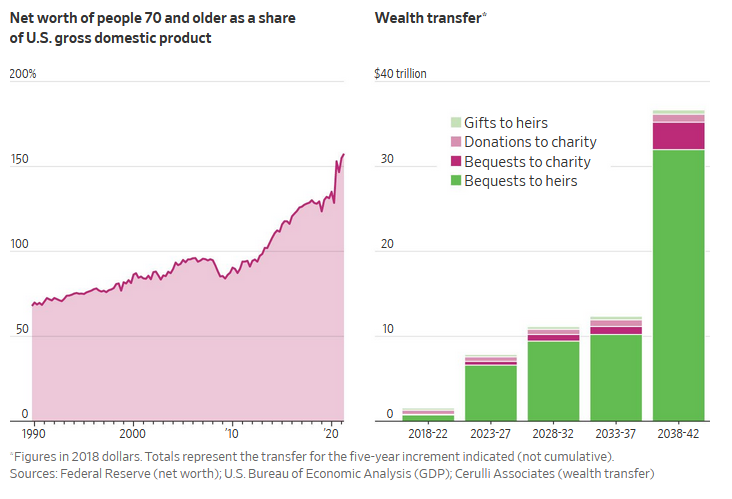

Older Americans, the baby boomer generation, in particular, control an enormous stockpile of money. The Wall Street Journal reports that from 2018 – 2042, 70 trillion dollars will be redistributed, with some 61 trillion dollars going to family heirs in the United States, according to Cerulli Associates, a research and consulting firm. The remaining balance will wind up in philanthropic endeavors. This transfer of wealth marks another display of the outsize economic power of baby boomers, coming of age in the post-World War II prosperity and driving the US economy throughout the stages of their lives.

Many benefactors are not waiting to gift monies until they die either. The recipients of this transfer that is already underway are and will continue to be primarily millennials and Generation Xers. The IRS reports annual gifts that taxpayers report see substantial increases in taxable gift reporting. Taxable gifting is a fraction of that which flows outside the tax system. The beginnings of this wealth transfer to the next generations are unleashing a torrent of economic activity such as purchasing homes, starting businesses, and creating non-government organizations to shelter wealth or straight donations to charity.

However, this burgeoning economic activity is being driven by younger generations that display lower levels of financial literacy than their benefactors. The Teachers Insurance and Annuity Association (TIAA Institute) reports only 11 percent of millennials to display a “relatively high” level of financial literacy, with 28 percent in the same group conveying a “very low” literacy rate in finances. Those in Generation X do not fare significantly better and overall struggle with saving and spending habits. Rather than preserving their inheritance, these generations may spend it on many things, including leisure activities, vacations, daily expenses, paying off college debt, medical bills, and health services.

To create multigenerational wealth, look beyond creating only your estate plan and have tough conversations about preserving wealth with your heirs. Benefactors experience a lot of fear about children and grandchildren knowing what they will inherit, concerned it will equal a loss of motivation and work ethic. Conversely, inheriting generations may also shield their financial status from parents and grandparents to avoid potential favoritism in gifting. Then there is the dynamic of how best to facilitate multigenerational communication. How can you ensure when you are gone, there is not an about-face by your heirs that will destroy your legacy hopes.

Financial vehicles like 529s and UTMAs/UGMAs are standard options to begin creating an aggregate of wealth for a child. However, patriarchs or matriarchs often send a check to their expanding family without the benefit of communicating to the new parents as though they can intuit how to handle the gift. There should be a conversation about the newborn child and everyone’s future hopes for them to honor the gifting process. Understand that while these accounts can work well in the short term, should these accounts be available in full to the child at age 18? What if the child receives a scholarship or does not want to attend college? What if the child is experiencing addictions or is too immature to preserve newfound inherited wealth? These simple financial vehicles can pose planning difficulties in the years ahead.

An estate planning attorney with a keen eye for generational wealth preservation may suggest creating a gift trust for the newborn. This trust type protects wealth and provides similar tax-free benefits from the newborn’s perspective. The grantor can make the gift and pay the taxes on behalf of the trust. Open communication within the family lets you know which generation currently has more assets and income to facilitate the gift trust better. You may also set up revocable living trusts (RLTs) that include grandchildren and children and may contain many asset types. These trusts can contain language instructing beneficiaries to set up new RLTs to address new members and new generations of the family.

While looking ahead two to three decades may be difficult, the best family estate plans address questions and concerns through multigeneration communication. Estate planning attorneys that address multigenerational estate and communication issues will structure your legacy plan to meet the needs of your family for generations to come. Each generation will have growing and changing needs, so proactive updates with your attorney as life events and law changes that inevitably occur will make your legacy plan sound. All family and finances are different, so it is imperative to speak with an estate planning attorney who knows the questions to pose and the structure to implement to best benefit your heirs and future heirs to come. Start planning your Legacy. Give us a call at (207)848-5600 or check out our CONTACT page for more ways to reach out to us.